What if the real reason behind your trading losses isn’t your strategy but the size of your trades? In forex, every trade you place depends heavily on one key factor, and you must know that “What is a Lot in Forex”. It quietly controls how much money you make or lose with every price movement.

In this article of ParamountMarkets, we will show you what 1 lot means in forex. We’ll break down the various types of lot sizes and guide you on how to choose the right one based on your capital, strategy, and risk tolerance. Stay with Paramount Markets as we walk you through everything you need to know about lot sizes. Then you can choose wisely and avoid costly mistakes in your trades.

What is a Lot in Forex?

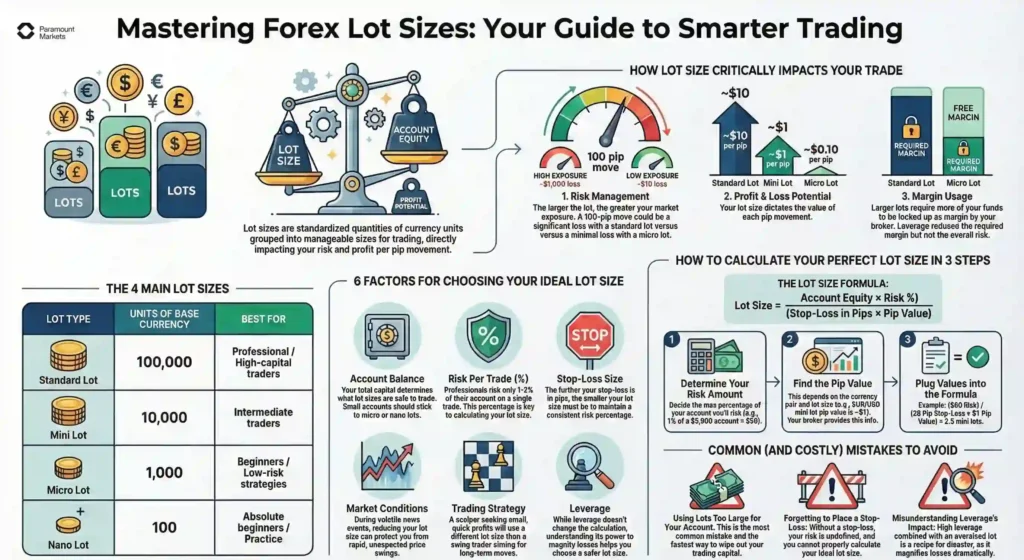

In forex trading, a lot is a way to measure the size of a trade. Since currency prices change in very small steps (called pips), trading just one unit isn’t practical. Lot size in forex makes it easier by grouping many units together, so trades can have a real impact. Your lot size affects how much you gain or lose when the price moves. A bigger lot means each pip is worth more. If you use leverage, this effect becomes even stronger.

Imagine buying bottled water. You wouldn’t normally ask for a small sip. Instead, you purchase a full bottle or even a pack of several bottles. It’s more convenient and makes the transaction easier. Forex works the same way. You don’t trade one euro. You trade a lot, like 1,000 euros (a micro lot). This makes the trade clearer and more efficient.

Understanding the Different Types of Lot Sizes in Forex

Types of lot size in Forex define the quantity of currency being bought or sold in one single order. To make trading easier, lots are grouped into standard sizes, so traders can choose the right amount of risk and exposure based on their goals and capital.

To help you understand “what is a lot size in forex”, we have defined each type individually:

The standard lot size is 100,000 units of the base currency. Standard lots are appropriate for professional traders with a relatively high amount of capital.

A mini lot is one-tenth of a standard lot, or 10,000 units, ideal for intermediate traders.

A micro lot consists of 1,000 units and is perfect for beginners or those testing strategies with minimal risk.

A nano lot is the smallest common size, equal to 100 units, great for absolute beginners or low-risk practice.

Lot Size in Forex Comparison Table

| Lot Type | Units of Base Currency | Best For |

|---|---|---|

| Standard Lot | 100,000 | Professional/High-capital traders |

| Mini Lot | 10,000 | Intermediate traders |

| Micro Lot | 1,000 | Beginners/Low-risk strategies |

| Nano Lot | 100 | Practice with minimal capital |

How Lot Size Affects Trading

Choosing a lot size for forex positions impacts factors beyond just the quantity of units traded. It shapes the risk you’re taking, the profit or loss you might see, and how much margin your broker will lock up. Lot size plays a major role in your entire trading strategy and knowing how it works is key to trading smart.

Risk Management

The larger the lot size, the more exposure you take on. That means even small price changes can have a big effect on your account. If you’re trading a standard lot and the market moves 100 pips against you, you’re looking at a $1,000 loss. But with a micro lot, that same move would only cost you $10.

Profit/Loss Impact

Lot size in forex also dictates how much you profit (or lose) with every pip movement in the market. The relationship is simple: the bigger the lot, the more every pip is worth. Here’s a quick idea of what that looks like:

- A standard lot moves about $10 per pip

- A mini lot moves about $1 per pip

- A micro lot moves about $0.10 per pip

- A nano lot moves about $0.01 per pip

So if you catch a 50-pip win, it could mean anything from $0.50 to $500, depending on the size of your position. In order to ensure more consistent profits and controlled losses, many traders prefer to trade with smaller lots even if they have significant trading experience.

Margin Use

Your broker will reserve a certain amount of your funds as margin for every trade that you open. The bigger your lot size, the more margin you’ll need. Without leverage, you would need a margin of $100,000 to trade a standard lot! With 1:50 leverage, you’d only need $2,000 but your trade is still running at full size, and so are the risks.

It’s easy to overlook how much of your margin is being used, especially if you’re trading multiple positions. That’s why tracking margin usage is just as important as managing your lot size.

How to Choose the Ideal Lot Size

Choosing the ideal lot size in forex is a decision that directly affects the amount you risk and how your account is doing in the longer run. This, however, should not depend only on a person’s confidence level. When selecting the proper lot size, a trader should consider his own match to the current position size to account balance, trading strategy, and market conditions.

Below are the key considerations you should evaluate prior to pressing that buy or sell button:

Account Balance

The account balance will determine the appropriate lot size. Larger accounts are able to cope with big trades, like trading mini lots with $10,000, while smaller accounts of approximately $1,000 must use micro or nano lots.

Risk per Trade (%)

Professional traders always risk 1-2% of their account per trade. For example, having $5,000 and risking 2%, your stop-loss limit on each trade would be $100, which regulates your lot size based on your stop-loss.

Market Conditions

During volatile markets or breaking news periods, price movements may be rapid and erratic, so reducing your lot size helps limit the losses. For example, reducing from mini to micro lots during times of central bank announcement is common.

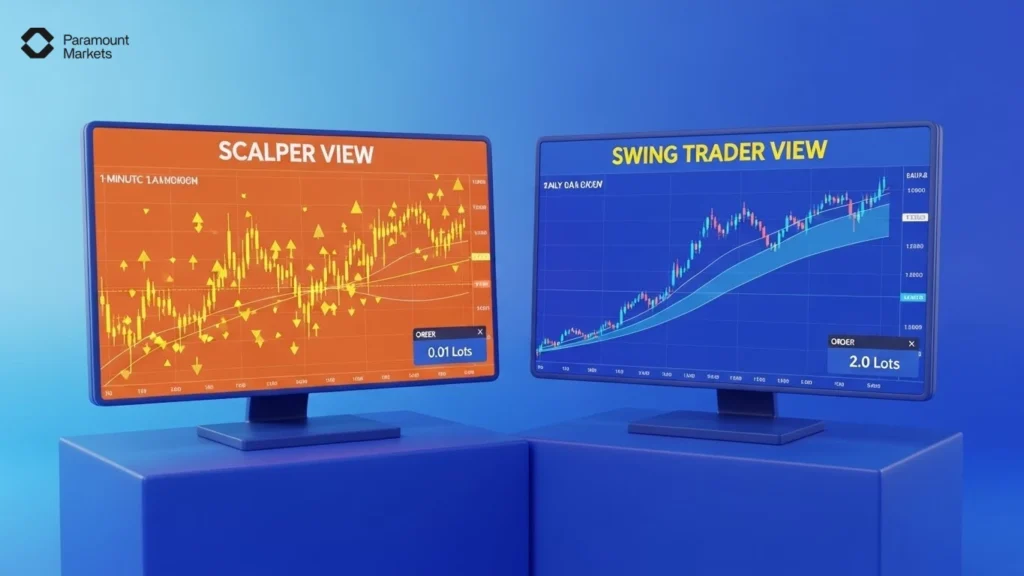

Trading Strategy

Your trading method controls lot size selection. Scalpers use small lots with tight stops for quick profit, while swing traders use large lots to benefit from lasting moves. Always use a lot size that fits your strategy.

Stop-Loss Size

The distance of your stop-loss from entry determines risk; the greater the stop, the smaller the lot size needs to be in order to keep risk consistent. For instance, a 50-pip stop means you’ll need a smaller lot than a 20-pip stop to risk the same amount of money.

Leverage

Leverage allows you to control larger positions with less capital; but also increases potential loss. The lot size you trade determines how much leverage you actually use. For example, 1:100 leverage lets you trade a mini lot with only $100 margin, but your full exposure, and risk remains.

Pro Tip: Always test lot sizes in a demo account before risking real funds.

How to Calculate Lot Size in Forex

It takes careful consideration of your account size, risk tolerance, stop-loss level, and the currency pair you are trading to choose the appropriate lot size.

The following formula can be used to calculate the optimal lot size:

Account Equity refers to the total value of your trading account, and risk percentage is the portion of your account equity you’re willing to risk on a single trade.

Follow these steps to know how to calculate lot size in forex the right way:

Step 1: Determine Your Risk

Start by deciding how much of your account you’re willing to risk on a single trade. This is typically 1% to 2% of your total equity.

For example, if your account balance is $5,000 and you want to risk 1%, you are risking $50 on this trade.

(Risk Amount = $5,000 × 0.01 = $50)

Step 2: Calculate the Pip Value

The pip value depends on the currency pair and lot size. A simple way to determine pip value is using the following formula:

Pip Value = (One Pip / Exchange Rate) × Lot Size

For most USD-based pairs (such as EUR/USD), a mini lot (10,000 units) is typically valued at $1 per pip, a micro lot (1,000 units) equals $0.10 per pip, and so on. Many brokers offer pip value tables or automatic tools to simplify this.

For this example, let’s assume you are trading EUR/USD, and the pip value is $1 per mini lot.

Step 3: Plug into the Formula

Now that you have the risk amount and pip value, use the main formula:

Lot Size = ($50) / (20 pips × $1) = 2.5 mini lots

So, you would trade 2.5 mini lots (or 0.25 standard lots) to risk exactly $50 with a 20-pip stop-loss.

Note: leverage does not affect the lot size calculation, but it does determine margin requirements, which traders should check separately

The Smart Way to Calculate Lot Size

Manual calculations can be time-consuming and prone to human error, which can be costly in live trading. Instead of risking mistakes, we recommend using a digital forex lot size calculator. These tools instantly determine the exact lot size based on your account balance and risk percentage, ensuring your risk management remains consistent, precise, and stress-free.

Lot Size Example Scenarios

Understanding how lot size works in real situations helps solidify the concept. Here are two example scenarios that show how risk, account size, and lot size come together in practice.

Scenario 1: A Beginner with a $1,000 Account

A new trader has a $1,000 account and wants to trade EUR/USD. They decide to risk 1% of their capital on a single trade, which equals $10. The stop-loss is set at 20 pips.

Since 1 micro lot (=1,000 units) typically has a pip value of $0.10, the cost of a 20-pip loss would be:

20 pips × $0.10 = $2

To risk the full $10, they could trade 5 micro lots (5,000 units), because:

5 micro lots × 20 pips × $0.10 = $10

This keeps the risk within limits and allows the trader to manage the position appropriately, even with a small account.

Scenario 2: An Intermediate Trader with a $10,000 Account

An intermediate trader has a $10,000 account and wants to risk 1% on a trade. That gives them a $100 risk budget. They set a stop-loss of 50 pips on EUR/USD.

Assuming a pip value of $1 per mini lot (10,000 units), the loss on one mini lot for a 50-pip move would be:

50 pips × $1 = $50

Since they can risk up to $100, they could trade 2 mini lots, as that would result in:

2 mini lots × 50 pips × $1 = $100

If the trade goes in their favor by 50 pips, they win $100. If the trade goes against them by 50 pips, they lose $100 – which is exactly 1% of their account.

Common Errors to Avoid

Selecting a proper lot size for risk management is one of those concepts where the majority of traders, especially beginners, make expensive mistakes.

The following are a few common mistakes to be aware of:

Opening Too Large a Lot Size on a Small Account

Trying to trade huge positions with a small balance will wipe out your account in moments. Choosing an appropriate lot size based on your account size is critical to prevent rapid drawdown from even a few small losses.

Forgetting to Place Stop-Loss

Not placing stop-loss orders is risky. Beyond limiting losses, a stop-loss also plays a vital role in calculating your ideal lot size; without it, you're trading blindly with unknown risk.

Lack of Understanding of Leverage's Impact

High leverage magnifies both gains and losses. Traders who ignore this often choose oversized lot sizes, which accelerates losses. Understanding leverage helps determine a safe lot size to protect your capital.

Start Trading with the Right Lot Size at ParamountMarkets

Starting with the appropriate lot size on ParamountMarkets is simple, even for beginners. Our trading conditions that are easily adjusted are there to help you have efficient risk management from day one:

- Minimum lot size of just 0.01 to have precise control over trade size

- Minimum deposit of just $10, which makes it easy to begin without large capitals

- Swap-free and commission-free accounts that allow you to concentrate on your trading plan

Trading a demo account or going live, with ParamountMarkets you can determine and trade lot size with ease and confidence. You can even practice completely risk-free with a demo session which simulates live market conditions.

Open Your Account Now and begin your journey towards smarter, more calculated trading with ParamountMarkets.

Conclusion

Choosing the right lot size in forex is key to smart trading. It directly impacts your risk, profit, and overall strategy. Whether you’re starting small or trading big, understanding lot sizes helps you stay in control. With tools and flexible conditions, ParamountMarkets makes it easy to trade confidently from day one.

In this guide, we aimed to cover everything you need to know about lot sizes in forex, using real examples to make each concept completely clear. We hope this lesson helps you make smarter trading decisions and achieve better results.

FAQ

What is the best lot size for a small $10 account?

For a very small account like $10, a Nano lot (100 units) is the only realistic option. It allows you to trade with cents rather than dollars, ensuring that a few losing trades don’t wipe out your entire balance immediately. It is perfect for practicing real-market discipline without significant financial risk.

How does leverage affect my lot size selection?

Leverage acts as a multiplier for your buying power. It allows you to open larger lot sizes with less capital (margin). However, it is important to remember that while leverage reduces the initial cost to enter a trade, it does not reduce the risk per pip. A standard lot moves $10 per pip regardless of whether you use 1:1 or 1:500 leverage.

Which lot size is recommended for beginners in forex?

Beginners should stick to Micro lots (0.01) or Nano lots if available. These sizes keep the monetary value of each pip low (around $0.10 or less), giving new traders room to make mistakes and learn from them without facing devastating financial losses.

How much capital is needed to trade a Standard Lot?

To trade a Standard Lot ($100,000 units) without leverage, you would need the full $100,000. However, most traders use leverage. For example, with 1:100 leverage, you would need approximately $1,000 in margin. Keep in mind that trading a standard lot with only $1,000 in your account is extremely risky and not recommended.

How much is 1 pip worth in different lot sizes?

crucial for calculating lot size. Generally, for USD-based pairs like EUR/USD:

- Standard Lot: 1 pip = $10

- Mini Lot: 1 pip = $1

- Micro Lot: 1 pip = $0.10

- Nano Lot: 1 pip = $0.01

Disclaimer: The information provided in this article is for educational and informational purposes only and does not constitute financial advice, investment recommendations, or an offer to buy or sell any financial instruments. Trading Foreign Exchange (Forex) and Contracts for Difference (CFDs) involves a high level of risk and may not be suitable for all investors. Leverage can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite. You should not invest money that you cannot afford to lose.