Imagine that you can earn money from a rise or a fall in the value of gold, Apple stocks, or Bitcoin without ever physically owning an ounce or a share. That’s exactly what CFD trading achieves.

In this article, we’ll explore “What is CFD trading”, how it works, what advantages and risks it carries, and how it compares to traditional investing. You’ll also learn how to get started safely, choose the right broker, and manage your risk effectively while trading global markets like forex, stocks, crypto, commodities, and more.

What is CFD Trading?

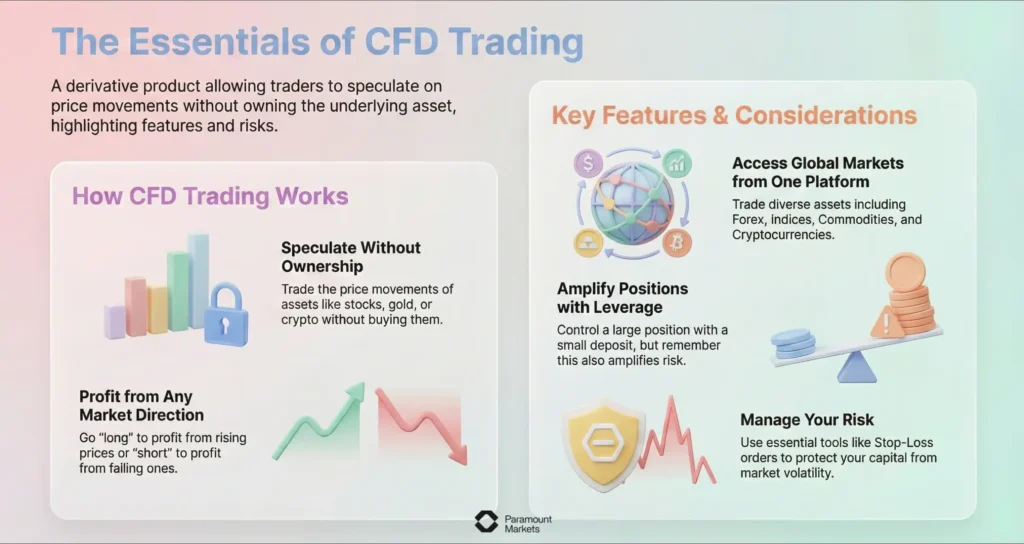

CFD or Contract for Difference is a monetary deal between trader and broker where they both agree to exchange the difference in the value of an asset from when the trade is opened to when it is closed. The big thing? You never ever actually own the underlying asset; you’re simply speculating whether its price will go up or down.

Imagine you are a weather forecaster. You can’t control the weather, but you can bet on what will happen, and get paid for getting it right. With CFD trading, likewise, you possess none of the actual gold, stocks, or crypto; you just try to know where the price is headed.

CFD trading is extremely versatile. Trade forex, commodities, cryptocurrencies, indices, and a whole lot more from the same trading platform.

CFDs give you access to financial markets worldwide, without having to own or pay for the underlying asset. However, since you’re trading strictly on price movement, profits as well as losses will be amplified; especially when using leverage in CFDs.

How Does CFD Trading Work?

CFD trading is based on the simple agreement to exchange the difference in the price of an underlying asset between the moment you enter into a contract and the moment you close. Here is how it works in steps:

- Selecting an asset: First, the trader selects the market or asset they wish to trade.

- Opening a position (long or short): The trader then decides if they think the price will rise (going long) or fall (going short).

- Applying leverage: CFDs are usually traded on leverage, which means you only have to deposit a small amount of the total trade value as margin.

- Profit or loss calculation: Profit or loss is calculated on the difference between the price at which the position was opened and the price at which it is closed.

Let’s say you buy a gold CFD at $1,900 an ounce. You then close the contract when the price is $1,950 an ounce. You make a profit of $50 an ounce for each unit that you have traded. If you had sold short, on the other hand, and dropped the price to $1,850, then you would have made $50 a unit by selling high and buying low.

Note: Even though you trade using the price of the asset, you never actually own the underlying physical product itself.

The Role of the CFD Broker

The intermediary in CFDs trading is the broker. Your broker facilitates the contract and gives you access to the market price when you open a CFD position. They do not sell the underlying asset to you but offer the price movements through the contract.

Brokers make money by charging spreads (difference between sell and buy prices), commissions or fees (swap fees, inactivity fees, withdrawal fees, etc.).

Because you do not own the underlying asset, CFDs are ideal for traders who wish to quickly enter and exit positions and do not want to deal with the physical aspects of ownership, storage and transfer fees.

Markets Available for CFD Trading

CFDs give you exposure to a very wide selection of markets. You can speculate on various asset classes without actually owning them.

Some of the most popular instruments you can trade with CFDs are listed below:

Forex pairs

The foreign exchange market or “forex” is the largest and most liquid market in the world, where all currencies are traded in pairs (such as EUR/USD or GBP/JPY). CFDs allow you to buy and sell currency pairs and speculate on the changes in their relative values.

Precious Metals

Gold (XAU/USD), silver (XAG/EUR) and platinum (XPT/USD) are among the most traded CFD assets, especially in times of economic crisis or uncertainty. They are often used as a hedge against inflation or currency fluctuations.

Cryptocurrencies

The digital currency market is expanding very quickly and is hugely popular among CFD traders. You are able to speculate on coins like Bitcoin (BTC/EUR), Ethereum (ETH/USD), or Litecoin and make money from price movements without actually possessing the coins.

Stock indices

Indices such as the S&P 500, FTSE 100 or NASDAQ track the performance of a collection of shares from a certain market or sector. When you trade index CFDs, you are speculating on the overall market or sector movements.

Shares

Shares CFD trading gives you the opportunity to speculate on the price movement of single stocks like Apple, Tesla or Amazon. You don’t need to own the underlying shares to profit from their price movement, either upwards or downwards.

Commodities

CFDs allow traders to speculate on natural resources, such as oil (UKOil/EUR), natural gas (NGAS/USD) or agricultural produce. Commodities can be highly volatile in price, and their changes depend on numerous factors such as the global demand and supply, weather conditions or geopolitical tensions.

In ParamountMarkets, we provide multi-asset CFD trading, so you’re able to trade all of these markets under one umbrella. If you’d rather specialize in one market or diversify yourself across many assets, CFDs enable you to do so.

The Advantages of CFD Trading

CFD trading is popular with traders for many good reasons, which all come back to flexibility, efficiency and access to global markets.

Here are the key benefits you can expect to find when trading CFDs:

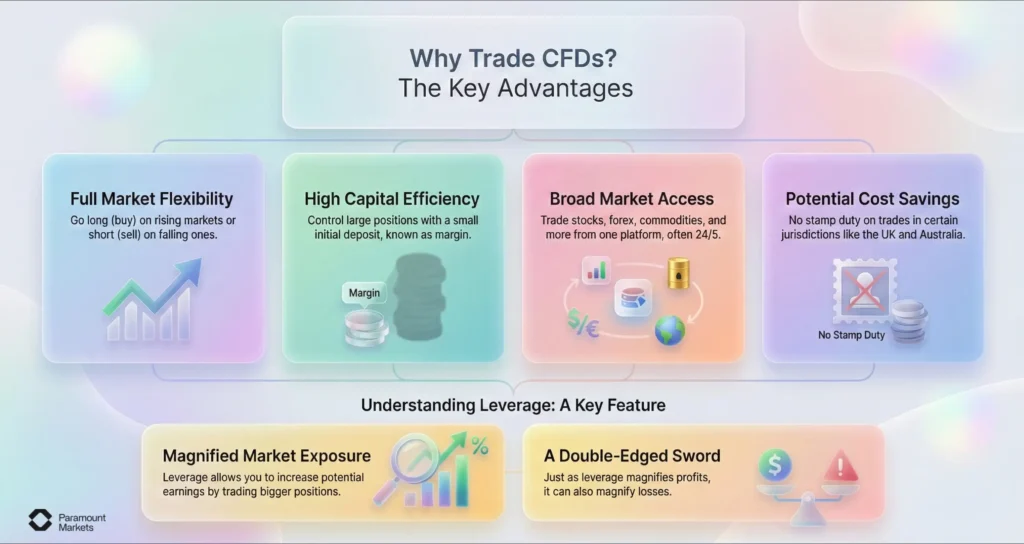

Flexibility & Market Access

CFDs allow you to trade on both bullish and bearish markets without any hassle. In other words, if you think the price of an asset will go up, you can simply go long (buy). If you expect it to go down, you can go short (sell) on the CFD market.

Plus, Many CFD markets, especially forex and major indices, are tradable 24 hours a day, five days a week, while single‑stock CFDs follow the hours of their underlying exchanges. This means you can access global markets at any time of the trading days if you are trading forex, commodities, stocks, or indices.

Leverage Possibilities

Leverage allows you to increase your potential earnings by trading bigger positions. With a 1: 100 leverage, for example, you can trade a $10,000 position with only $100 in your account.

Do keep in mind, though, that just as leverage can magnify your profits, it can also magnify your losses. It’s important to manage your risk properly.

Capital Efficiency

One of the best things about CFD trading is the low entry requirement. As you only have to put down a fraction of the total trade value as margin, you don’t have to commit a lot of capital upfront.

This allows you to enter trades with smaller amounts of money and still have control over larger positions.

At ParamountMarkets, you can open a live trading account with just $10. This low minimum deposit makes it easy to start trading without tying up a large amount of capital.

Diverse Asset Classes

CFDs allow you to trade on a wide range of financial instruments, including stocks, forex pairs, commodities like gold and oil, and even cryptocurrencies, all on a single trading platform. Not to mention, you’re speculating on price movements and not dealing with ownership of the underlying assets which makes it easier and cheaper in most cases.

No Stamp Duty (in Some Jurisdictions)

Since you don’t technically own the underlying asset when you’re trading CFDs, some jurisdictions like the UK and Australia don’t charge stamp duty on your trades. This can result in lower total costs than traditional investing.

Important: Tax regulations differ by jurisdiction and are subject to change over time. Always consult with a qualified tax professional to determine your individual circumstances.

Risks of CFD Trading

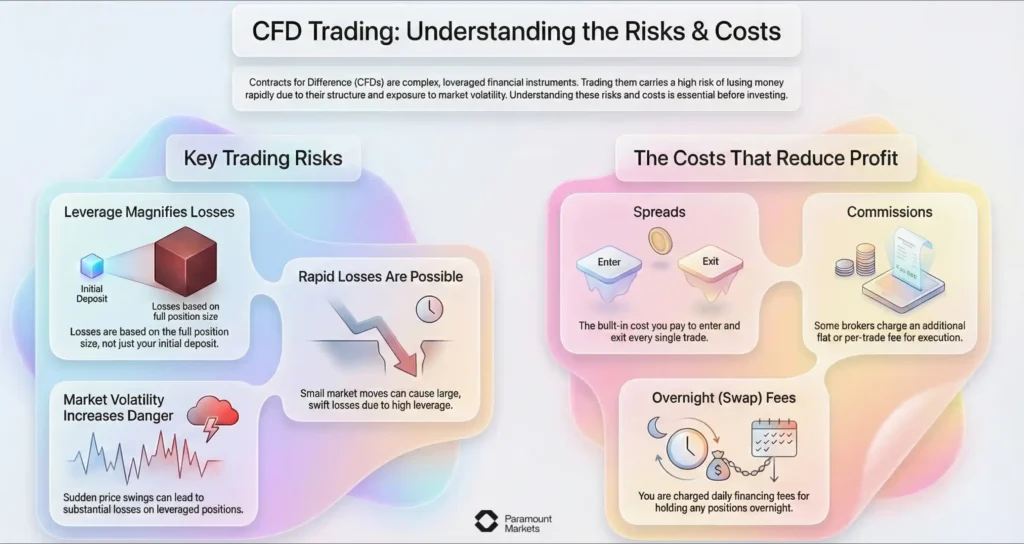

Trading CFDs involves a number of risks that all traders should be familiar with absolutely prior to investing. CFD risks come from two main sources: their complex, leveraged structure and overall market volatility.

Fast Losses Possible

CFDs are complex instruments and expose you to high risk of losing your money rapidly due to leverage. Trading on margin, even small price movements can result in large losses in a short time.

Leverage Risks

Leverage allows you to control a position larger than your initial capital. Losses are calculated on the full size of the position, not on the portion of capital used as margin. Therefore, if the market moves against you, you can lose more than the amount of the initial deposit unless negative balance protection or similar safeguards are in place with your broker.

Market Volatility

Markets can be extremely volatile, with rapid price swings caused by economic news, geopolitical events, or unexpected developments.

Large, sharp price moves can lead to substantial losses, especially if you’re on the wrong side of a trade and have a big position size, or if you’re highly leveraged.

Trading Costs

Beyond market risks, CFD trading involves several costs that impact profitability:

- Spreads: Difference between the cost of selling and buying price, and essentially a charge you pay each time you enter and exit a trade.

- Commissions: Some brokers also charge a per-trade fee or per-lot fee, additionally charging you.

- Swap Fees (Overnight Financing): In the event you carry overnight positions, you will be charged per-day financing fees in accordance with current interest rates and broker commissions.

These costs must be factored into your trading strategy because they reduce net yields and compound over time.

Importance of Risk Management in CFD Trading

Risk is unavoidable, but a well-managed risk is manageable. Techniques such as stop-loss orders prevent possible losses by automatically closing a position when prices fall to a given level. Take-profit orders, in turn, lock in gains through closure of trades as soon as a target is achieved.

You can protect your capital and avoid emotional trading during volatile market movements with regular use of these tools.

Key Considerations Before Trading CFDs

CFD trading won’t make you rich overnight. It requires skill, discipline, and a solid understanding of what you’re getting into.

Here are the things you should keep in mind:

CFDs may not be suitable for you if you are not comfortable with the risk of losing more than your initial investment.

CFDs are not exclusively for seasoned traders, but they are more suitable for individuals who have at least some basic knowledge of market operations.

Leverage can amplify gains, and losses. Make sure you know how margin calls work and how positions can move against you quickly before you start.

CFDs should be watched, and the markets followed with some frequency. You should monitor the markets while educating constantly to be the best.

If you’re simply looking for fast gains without a defined plan, it’s likely to lead to frustration rather than success.

Real success in CFD trading comes from patience, learning, and disciplined risk management; not gambling on market swings.

CFD Trading vs Traditional Investing

Despite the fact that both aspire to gain returns, they approach it in extremely distinctive manners; each for distinct types of investors with distinct goals, horizons, and appetite for risk.

Here’s a brief table about CFD trading vs traditional investing:

| Feature | CFD Trading | Traditional Investing |

|---|---|---|

| Asset Ownership | No ownership of the asset | Full ownership of assets |

| Market Direction | Profit from rising or falling markets | Profit only when prices rise |

| Leverage | Yes (common, e.g., 1:30) | Rarely used |

| Time Horizon | Short- to medium-term | Long-term (months to years) |

| Cost Structure | Spreads, overnight fees | Broker commissions, fund management fees |

| Risk Level | Higher (due to leverage and volatility) | Generally lower but still market-linked |

| Suited For | Active traders comfortable with risk | Passive investors seeking long-term growth |

Practical Tips for Getting Started

Before engaging in CFD trading, you have to have a solid foundation. This is not an area where you can “wing it.” A little preparation, discipline and the right tools can make all the difference.

There are some important steps that you should take to start trading intelligently.

Learn the Basics

Learn about CFDs before investing real money. Understand how leverage can amplify profits and losses. Find out why risk management is essential to trading. Learn how margin requirements, position size and stop-loss orders work; it’s not a choice.

Choose the Right Broker

Seek a provider who is thoroughly regulated, offers a user-friendly platform, and offers transparent prices. Low spreads and commission are easy to have, but do not compromise on execution speed, platform stability, and customer support quality.

Start with Small & Care for Risk

The smartest traders begin small. Practice with a demo account. This is a great way to get comfortable with the conditions in the market and test out your strategy with no risk. Trade small in a live account with risk limiting tools (stop losses) when you first start out.

Stay Informed

Keep track of financial news, central bank statements, economic reports, and geopolitics. Add this to technical analysis to identify trends and refine entry and exit points. Traders who keep current are always better equipped.

Why Trade CFDs with Paramount Markets?

Choosing the right broker is not an afterthought; it is make-or-break for your trading results. ParamountMarkets offers a trading experience focused on clarity, reliability, and customer success.

Find out why many traders put their trust in ParamountMarkets:

Competitive fees enable you to retain more of your profits. Our swap-free account options offer convenience for varied trading philosophies and strategies.

As a reputable offshore broker, we prioritize your safety by adhering to strict standards and employing advanced encryption.

Blisteringly quick order execution means you never miss the crucial entry and exit points.

Markets don't sleep, and neither do we. Our expert support team is here 24/7 to assist when you need it most.

If you’re starting small or looking to grow, ParamountMarkets gives you the tools and confidence to expand. Ready to open up CFD trading with a trusted partner?

Conclusion

CFD trading offers the trader a flexible way to access global financial markets without actually owning the underlying investments. You can speculate on rising and falling prices with limited capital investment; but it also comes with increased risks through leverage and volatility.

In this article, we have attempted to simply explain and inform you of “What is CFD trading”, how it works, the markets available, and how to enter into it smartly. Whether you’re starting out or wish to make your strategy more optimized, we hope that this guide allows you to trade CFDs smarter and with greater confidence.

Start trading securely on ParamountMarkets trusted platform with a low minimum deposit, giving you fast access to the markets and full control over your investments.

FAQ

Is CFD Trading Right for You?

CFD trading suits individuals who are comfortable with short-term market speculation and managing high-risk scenarios.

What Makes CFD Trading Different from Stock Investing?

In CFD trading, you don’t own the asset; you only trade on price movement, often with leverage. Stock investing involves owning shares for long-term growth, usually without leverage or short-selling.

How Much Capital Do You Need to Start CFD Trading?

You can start with a relatively small amount depending on your broker and account type.

Disclaimer: The information provided in this article is for educational and informational purposes only and does not constitute financial advice, investment recommendations, or an offer to buy or sell any financial instruments. Trading Foreign Exchange (Forex) and Contracts for Difference (CFDs) involves a high level of risk and may not be suitable for all investors. Leverage can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite. You should not invest money that you cannot afford to lose.

One Response

I used to be suggested this website by way of my cousin. I am no longer sure whether or not this publish is written by way of him as nobody else understand such specific about my problem. You’re incredible! Thanks!