Did you know that trillions of dollars are traded across the world’s financial markets every day?

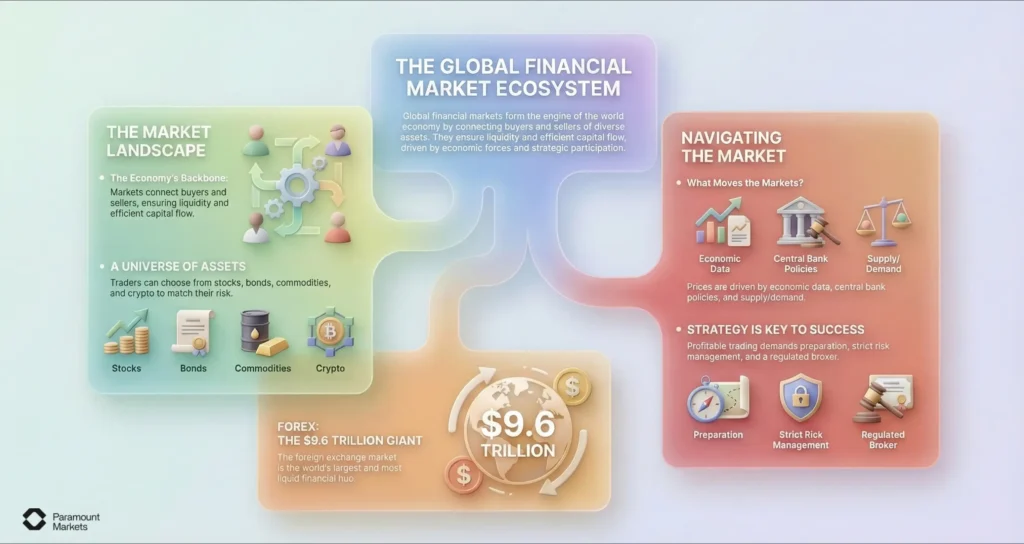

Understanding financial markets is essential – they are the economic backbone of the world, connecting buyers and sellers of all kinds, from individuals to businesses to governments, when it comes to buying and selling assets. By understanding how financial markets work, you will be able to make smart financial choices and know how to spot profitable opportunities.

When I first heard the term “financial markets”, it sounded so complicated and intimidating that I thought only Wall Street gurus could understand it. But the basic idea behind “what is a financial market” is actually quite straightforward, and definitely something anyone can grasp. Stay with us as we explore the financial market definition and offer the best way to get in! Stay with us as we dive into financial markets explained and offer the best way to get in!

What is a Financial Market?

The financial market provides a formal framework that enables traders to trade various financial instruments including stocks, bonds, commodities, and derivatives.

These markets enable capital distribution which allows businesses to secure funding while giving investors opportunities to expand their financial portfolios. Financial markets function as the connection point for capital seekers and investors with excess money to deploy.

A financial market functions like a massive trading arena where people exchange company ownership (stocks), debt obligations (bonds), and basic materials (commodities) instead of everyday goods like fruits and vegetables.

Financial markets provide:

- Ensure liquidity

- Promote fair pricing

- Allow investors to manage risks effectively

Financial markets exist to provide liquidity which allows assets to be bought and sold swiftly. These markets enable price discovery which establishes fair asset values through supply and demand analysis.

Price discovery, by the way, is just a fancy term for the market figuring out what something is actually worth. kind of like how prices get set at an auction based on who’s willing to pay.

Different Types of Financial Markets

Financial markets can take many different forms. Some focus on the buying and selling of shares in companies, others concentrate on trading debt instruments, commodities, or currency.

Stock Market

In the stock market, investors can purchase shares in publicly listed companies. Stocks give companies access to capital to help fund their growth. They also give investors the opportunity to own a piece of a company and potentially profit from an increase in the company’s share price and/or dividends.

A basic understanding of the stock market revolves around:

- Supply and demand

- Market capitalization

- Economic conditions that influence stock prices.

For example, NASDAQ is one of the largest stock exchanges in the world by market capitalization and is known for its technology-focused listings such as Apple, Microsoft, Amazon.

The New York Stock Exchange (NYSE) is another one of the largest financial exchanges in the world by market capitalization. Many well-known blue-chip companies such as Coca-Cola and Johnson & Johnson trade on the NYSE, and it is a major center of finance in the world.

You’ve likely heard of some of those companies before – in fact, if you own some of their stock, you own a little piece of them!

Bond Market

The bond market is where governments and corporations issue debt securities to finance their operations or projects. Bonds are essentially loans made by investors to the issuing entities in exchange for periodic interest payments and the return of principal at maturity.

In comparison to stocks that depend on business growth and dividend payouts, bonds provide investors with greater safety because they represent loans to companies or governments. With bonds, you’re lending the company money and then they pay you interest back on that money.

The bond market is important because it is a mechanism for capital formation. By issuing bonds, companies and governments can raise funds for infrastructure development, expansion, and other projects.

Commodities Market

The commodities market is a market where physical goods like oil, gold, wheat, and natural gas are traded. Commodities markets help to maintain price stability in the economy by allowing producers and consumers to hedge their exposure to price changes through future contracts.

You’ve all been to the Commodities markets, you’re just not aware of it! Commodities markets can be exciting! you’re trading in things that are real, that you can touch, taste, and see.

For example, the oil that fuels our vehicles and the gold that’s in our jewelry. The prices of these commodities can change rapidly based on the weather (crop production), political situations, or supply and demand.

Indices Market

Indices markets track the performance of selected collections of stocks, bonds and other financial instruments. They provide a snapshot of the economic conditions in the market.

Examples of the Indices market are S&P 500, Dow Jones, and FTSE 100. Indices can help investors to gauge the overall market sentiment and make informed trading decisions.

By the way, an interesting fact is that Indices are also like “market weather vanes”. If you hear “The S&P 500 is up” it will give you a very rough idea of how the broad stock market is doing in the US.

Derivatives Market

Derivatives markets are financial markets that trade in contracts whose value is derived from underlying assets such as stocks, commodities, or currencies. Futures, options, and swaps are common derivatives.

Derivatives help you to hedge against price fluctuations and manage risk as an investor.

Cryptocurrency Market

Digital currencies such as Bitcoin and Ethereum along with other altcoins are traded on cryptocurrency markets. Unlike the traditional markets, cryptocurrency markets are decentralized, and transactions are recorded on a blockchain network.

The crypto market is fairly new, so it’s still different from traditional markets like stocks. Cryptocurrencies can be highly volatile, and the market is constantly evolving.

Forex Market

The Forex market, or foreign exchange market, is a global marketplace for the trading of currencies. Participants in the forex market buy, sell, and exchange currencies at current or determined prices.

Forex is HUGE, and Forex trading happens on a global scale and is the largest financial market in the world. This means that currencies from every country are traded on the forex market.

If you have ever changed currency while traveling in another country, you have used the forex market, although you may not have been aware of it.

The forex market facilitates cross-border trade and investment by allowing currency conversion, which also affects monetary and fiscal policy decisions around the world.

Forex market liquidity helps to ensure that there is an efficient price discovery process and that risks can be properly assessed and managed. You should use economic indicators and investment strategies to trade currency pairs and mitigate risk in forex.

Key Influences on Financial Markets

Supply and demand remain the primary drivers of financial markets while additional factors also influence market behavior:

Data such as GDP growth, unemployment rate, and inflation can have a direct impact on the market sentiment. I always keep an eye on inflation reports! they can really move markets!

Elections, trade wars, and geopolitical tensions can also cause significant market fluctuations. Remember Brexit? Or major elections? Those events sent shockwaves through the markets.

Changes in interest rates by central banks or changes in government tax policies can also influence the markets and affect investor behavior. Central banks have a big impact on the markets. When they change interest rates, it’s kind of like they have a steering wheel on the market.

Who Trades Financial Markets?

There are many financial market participants such as banks, (UAE Central Bank CBUAE), and institutes who buy or sell in these markets. They must all play their parts to keep the markets working effectively and with stable prices.

Here are the main financial market players:

Institutional Investors

These are organizations, which are large in nature, such as pension funds, mutual funds, microfinance companies, insurance companies, and others. Institutional investors are responsible for massive capital deployment and generally have larger investments to make than retail traders. Liquidity and general asset price levels can be affected by these large investment funds.

These are the “big players” – think huge investment companies who are investing billions of dollars worth of other people’s money. They are like whales swimming around in the sea, and when they move around, the whole ocean moves with them. When they make a move, the market notices.

Brokers

Brokers are intermediaries who act on behalf of investors (like you) in the financial markets. They execute orders for you in the markets; when you wish to buy or sell, the broker will buy or sell on your behalf.

Brokers contribute to market efficiency and price discovery in financial markets by ensuring fair pricing and order execution, brokers. Brokers are essential – they’re your gateway to the market. Selecting a broker can be a very important step for traders.

Banks

Banks can act as brokers by transacting on behalf of their clients. But, banks can also transact for their own account, either for profit or to hedge possible losses.

Financial institutions serve as intermediaries which facilitate the flow of money between savers and borrowers to promote economic expansion and capital creation. Examples include banks such as the Central Bank of the UAE.

Retail Investors

Retail investors are individual investors, like you and I, that trade financial markets with their own personal funds. Trades are executed under regulatory oversight such as the SEC (U.S.) or other regulation within each country.

Individual retail traders typically exert less influence on the market than institutional investors but collectively they possess notable market power. By investing across multiple investment products, retail investors provide market liquidity which helps stabilize markets and increase market participation.

That’s us! The average Joe or Jane can get in on the action as well, by trading with online brokers. It’s great to be able to participate in markets too and grow your own wealth just like institutions.

Why Are Financial Markets Important?

As we have discussed throughout this chapter, financial markets are the heart of the economy. They provide a way for people to buy and sell financial instruments and capital. They also help to channel funds into the economy and stimulate growth. Here are just a few of the reasons why financial markets are so important.

Some of the Key Reasons Financial Markets Matter are:

Facilitating Economic Growth

Financial markets offer businesses access to capital formation, enabling them to expand, innovate, and generate employment. Companies raise money for building new factories and developing technologies through financial markets.

Efficient Capital Allocation

Investors direct their funds into sectors where they expect maximum returns which promotes market efficiency.

Providing Investment Opportunities

Stocks, bonds, and derivatives serve as investment mechanisms that help individuals and institutions build their wealth progressively. Markets provide opportunities for diversification and strategic investment planning.

Risk Management and Hedging

Traders and investors can use financial instruments like futures and options to hedge against risks, protecting their investments from sudden market fluctuations.

Liquidity and Price Discovery

Price discovery in financial markets enables investors to establish the true value of assets based on supply and demand dynamics.

Enhancing Financial Stability

A robust financial market contributes to overall market stability, allowing businesses, governments, and individuals to operate with confidence.

Regulatory Frameworks and Market Innovation

Financial markets are governed by regulatory frameworks that prevent fraud and market manipulation, while also promoting financial innovation.

Key Essentials for Trading in Financial Markets

Successful trading in financial markets requires preparation, discipline, and a thorough understanding of financial instruments. While trading can be profitable, it is also associated with risks, so it is important to adhere to organized strategies and risk management techniques. Therefore, remember the following tips!

Research and Planning

One of the first steps to becoming a successful trader is research and planning. Many people make the mistake of jumping into trading without a clear understanding of financial markets or without a trading plan.

This can lead to emotional and impulsive trading decisions that are more likely to result in losses. It’s essential to educate yourself on trading and financial markets before starting and to create a well-thought-out trading plan.

The following tips will help you develop a comprehensive trading plan:

- Keep track of economic conditions and trends in MENA and global financial markets.

- Learn about the different types of financial markets (e.g., stock market basics, capital markets MENA) to determine where you want to trade.

- Set clear and achievable goals, whether you’re interested in long-term portfolio diversification or short-term speculative trading.

By creating a solid trading plan, you can minimize emotional trading decisions, trade more efficiently, and increase your chances of becoming a consistently profitable trader.

Choosing a Strategy

Pick a strategy that suits your risk appetite, trading style, and financial objectives. Some traders favor long-term investing, while others prefer short-term speculation.

Popular Trading Strategies are:

- Day Trading

- Swing Trading

- Value Investing

- Trend Following

A clear strategy allows you to take calculated risks while minimizing unnecessary exposure and optimizing returns through prudent capital allocation.

Analysis and Risk Management

Risk management in financial markets is an essential component of successful trading. Without an effective risk management plan in place, even the most experienced traders can quickly find themselves in deep water.

Technical Analysis Focuses on the use of historical price data, market liquidity, and trading patterns to predict future price movements.

In contrast, fundamental analysis looks at a variety of economic factors such as financial statements, economic indicators, and geopolitical events in order to determine the intrinsic value of an asset.

Pay attention to the following tips to keep your investments safe:

- Use stop-loss orders to limit potential losses.

- Diversify your holdings to reduce exposure to any single asset.

- Consider macroeconomic trends, fiscal policy, and monetary policy before making trades.

Continuous Learning and Education

Successful traders recognize that financial literacy is a journey, and that they need to adapt to changes in economic development and financial innovation. Learning from past financial crises can help you navigate volatility with more ease.

Additionally, taking courses, analyzing markets, and networking with other traders can improve your financial decision-making skills. The more you learn, the smarter you get in the markets!

Forex Position in the Global Financial Ecosystem

Forex is not just another asset class; it is the lifeblood of international trade, capital flows, and economic expansion. It’s not limited to the private sector, as many governments use it as a foreign exchange policy and economic correction tool.

So why Forex is unique in the financial markets landscape?

Forex markets are open 24/5 (trading hours, unlike stock exchanges with set hours). This flexibility attracts many traders from all over the world.

With over $9.6 trillion in daily volume, forex is the largest and most liquid market in the world.

The forex market is decentralized, with no central exchange. Trading is conducted over-the-counter (OTC) via a global network. This reduces reliance on a single point of control and can increase market resilience.

Forex is critical to the economy; currencies have a direct and immediate correlation with the economy via economic indicators like GDP growth, inflation rates, and employment data.

Role of Forex Brokers in Global Financial Markets

Forex brokers serve as intermediaries between traders and the forex market. They provide access to the market, facilitate transactions, and offer tools for decision-making. Without brokers, individual traders would have limited access, as direct participation in interbank currency exchanges requires significant resources.

Offering Trading Platforms and Tools

Forex brokers provide powerful platforms that allow traders to analyze the market and execute trades efficiently. These platforms offer advanced tools and charts, enabling informed decision-making.

Providing Liquidity and Market Access

Forex brokers play a crucial role in ensuring market liquidity, which is vital for smooth trading operations. Liquidity refers to the ease with which an asset can be bought or sold without significantly impacting its price. Additionally, brokers facilitate access to various markets, expanding the range of trading opportunities and allowing investors to diversify their portfolios.

Gain Access to Forex and CFD Trading with ParamountMarkets

Want to get started with forex and CFD trading? With ParamountMarkets, you can!

With ParamountMarkets, you gain access to a wide variety of financial instruments, including forex and CFDs. Trade all of your favorite major currency pairs, commodities, and global indices with fast execution speeds and competitive spreads.

With Paramount Markets, you receive:

- Advanced trading tools and multiple accounts

- Real-time price discovery mechanisms

- Educational resources to enhance your trading strategies

The platform supports traders in navigating capital markets MENA with a clear understanding of market efficiency, economic indicators, and investment strategies. Take advantage of these exclusive opportunities by registering now and start trading with confidence!

MENA Financial Markets

MENA financial markets (Middle East and North African, includes UAE, Qatar, Saudi, etc) are special!

The MENA region’s financial markets reflect its economic dynamism, regulatory landscapes, and its involvement in global trade. With increasing foreign investment and government initiatives, MENA stock markets are witnessing a transformative phase, presenting opportunities for traders and investors.

However, one important issue in MENA financial markets is risk management. The market volatility, geopolitical events, and changing economic scenarios in this region, make it crucial for traders to practice well-informed and well-researched investment decisions.

MENA’s financial infrastructure consists of a network of central banks, regulatory authorities, stock exchanges, and international financial institutions. These organizations promote transparency, liquidity, and investor protection in MENA markets.

Central banks like the UAE Central Bank and SAMA set monetary policies, while stock exchanges such as Tadawul, DFM etc, provide platforms for trading.

International organizations like the IMF, World Bank also contribute to economic stability in MENA. The region is becoming more interconnected with global financial markets every day.

Key Financial Institutions in MENA and Global Markets are:

| Category | Institutions | Description |

|---|---|---|

| Central Banks & Monetary Authorities | UAE Central Bank (CBUAE), Saudi Arabian Monetary Authority (SAMA), Central Bank of Bahrain (CBB), Central Bank of Egypt (CBE), European Central Bank (ECB) | Regulate monetary policy, ensure financial stability, and supervise banking operations. |

| Regulatory & Supervisory Bodies | Securities and Commodities Authority (SCA), Dubai Financial Services Authority (DFSA), Abu Dhabi Global Market (ADGM) Authority, Qatar Financial Centre Regulatory Authority, Financial Services Authority (FSA), Securities and Exchange Commission (SEC) | Oversee financial markets, enforce regulations, and ensure compliance to protect investors and market integrity. |

| Stock Exchanges | Dubai Financial Market (DFM), Abu Dhabi Securities Exchange (ADX), Saudi Stock Exchange (Tadawul), Qatar Stock Exchange (QSE), Cairo and Alexandria Stock Exchange (CASE), New York Stock Exchange (NYSE), London Stock Exchange (LSE) | Facilitate the buying and selling of securities, enabling capital flow and efficient price discovery. |

| Financial Hubs & Investment Centers | Dubai International Financial Centre (DIFC), Qatar Financial Centre (QFC) Authority | Act as major financial hubs offering a regulatory framework, financial services, and investment opportunities. |

| Commercial & Investment Banks | Emirates NBD Bank, MashreqBank, Abu Dhabi Islamic Bank (ADIB), Investcorp | Provide banking services, investment solutions, and financing for businesses and individuals. |

| International Financial Organizations | International Monetary Fund (IMF), World Bank | Support economic development, financial stability, and global trade through policy guidance and funding. |

Islamic Finance and Financial Markets

IIslamic finance provides ethical and Sharia-compliant investment opportunities. This type of finance has become popular in the MENA region and across the world.

Islamic banking differs from conventional banking. It bans interest (riba) and instead offers investment products that are based on risk-sharing. Islamic finance also closely aligns with financial literacy, as it follows the principles of fairness, market efficiency, and ethical allocation of capital.

Conclusion

Financial markets play a crucial role in the global economy by facilitating the exchange of money and securities between businesses, governments, and investors. All financial markets are vital to the world’s economy, as they play a critical role in maintaining financial stability and enabling the flow of capital.

If you’ve ever asked yourself, “What is a financial market?”, the answer is simple: it’s a system that brings together buyers and sellers to trade financial assets – everything from currencies to stocks and commodities. With financial markets explained, it becomes clear how these systems influence everything from interest rates to investment opportunities.

A solid understanding of financial markets – including their trends, liquidity, and key economic indicators – will help you make smarter trading decisions and better manage volatility.

If you’re looking for a trusted Forex and CFD broker, sign up at ParamountMarkets today and start trading!

FAQ

How much money do I need to start trading in financial markets?

You don’t need millions. While institutional investors trade with huge capital, retail traders can start with small amounts (e.g., $10 or $100) using CFDs and leverage. Brokers like ParamountMarkets offer flexible account types to suit different budgets.

Which financial market is best for beginners?

It depends on your goals. The Stock Market is often preferred for long-term investing and stability. However, the Forex Market is popular among beginners for short-term trading due to its high liquidity, 24/5 availability, and low barrier to entry.

What are financial markets?

A financial market is a marketplace where buyers and sellers trade assets such as stocks, bonds, currencies (Forex), and derivatives. Its primary functions are to determine fair prices, ensure liquidity, and facilitate global trade and efficient capital allocation.

Disclaimer: The information provided in this article is for educational and informational purposes only and does not constitute financial advice, investment recommendations, or an offer to buy or sell any financial instruments. Trading Foreign Exchange (Forex) and Contracts for Difference (CFDs) involves a high level of risk and may not be suitable for all investors. Leverage can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite. You should not invest money that you cannot afford to lose.